What Are SIPs, Mutual Funds, and ETFs? Learn the Basics of Investing

What are SIPs, mutual funds, and ETFs? Learn the basics of investing with this beginner-friendly guide by RedCarpetLife. Understand key terms, top funds, and smart strategies to grow your money.

What are SIPs, mutual funds, and ETFs? If you’re just starting your investment journey, these terms might sound confusing. But understanding them is the key to building long-term wealth. With the right knowledge, even beginners can make smart and confident investment choices.

At RedCarpetLife, we simplify finance for everyone. In this guide, we break down what SIPs, mutual funds, and ETFs mean, how they work, and why they matter for beginner investors. No complex terms, just clear answers.

If you want to grow your money but don’t know where to begin, this article is for you. Whether you're saving for the future or learning to invest, SIPs, mutual funds, and ETFs are great tools to start with.

What Are SIPs, Mutual Funds, and ETFs?

What is SIP (Systematic Investment Plan)?

Think of SIP like growing a money plant. You don't pour a bucket of water on day one and expect it to bloom. Instead, you water it every few days, little by little — and slowly, it grows. A Systematic Investment Plan, or SIP, works the same way. It's a method where you invest a small amount regularly, usually monthly, into a mutual fund, helping your money grow over time without needing to invest a large lump sum.

How It Works

Once you set up a SIP, a fixed amount, say ₹500 or ₹1,000, is automatically deducted from your bank account each month and invested into your chosen mutual fund. You choose the amount, the date, and the fund. The best part? You don’t have to track the market every day.

Over time, SIP uses rupee cost averaging, which means when markets are low, you buy more units, and when markets are high, you buy fewer. This balances your investment cost naturally. And because your money stays invested, compounding kicks in — your earnings start generating more earnings.

Example for Better Understanding

Let’s say you start a SIP of ₹1,000 every month in an equity mutual fund. In the first few months, you might see slow growth, and that’s okay. Just like watering a plant, you won’t see flowers instantly. But over 5 or 10 years, those small ₹1,000 steps will turn into something big, all thanks to consistency and patience.

You don’t have to guess how much you’ll earn — you can try our SIP calculator on Arthalogy to see potential returns based on how much and how long you invest.

Who Should Use SIP

SIP is perfect for beginners who want to start small and grow gradually. It’s great for salaried professionals, students, homemakers — anyone with a monthly income who wants to build wealth without feeling overwhelmed. It’s also ideal for people who don't want to risk investing a huge amount all at once.

If you’re someone who prefers steady growth without watching the stock market daily, SIP is designed for you.

Key Benefits of SIPs

Think of SIP like planting seeds every month. One seed may not look like much, but when planted consistently, it turns into a forest. SIPs help you do just that — grow financial stability drop by drop.

Here’s why SIPs are so powerful:

- Helps build wealth gradually without burden

- Makes you disciplined with money

- Automatically balances risks through rupee cost averaging

- Compounding rewards long-term investors

- No stress of timing the market

- Flexible — increase, pause, or stop whenever needed

And if you're curious how much your monthly SIP might turn into, check out the SIP calculator on Arthalogy — it’ll help you plan better and dream bigger.

What is a Mutual Fund?

Imagine a group of friends pooling pocket money to buy an ice cream cart instead of one person buying a full machine. With collective funds, they can own a bigger, better cart. Similarly, a mutual fund pools small savings from many investors to buy a diversified basket of stocks, bonds or both. Expert fund managers handle the investing, so individual investors benefit from professional management and diversification without buying individual assets themselves.

Types of Mutual Funds

Just like there are different types of vehicles for different journeys, a bike for quick rides, a car for comfort, and a truck for heavy loads, mutual funds also come in different types based on your goals and risk appetite.

1. Equity Mutual Funds

These funds invest mostly in company shares. They aim for long-term capital growth and are ideal for investors who can take some risk in exchange for higher potential returns.

Sub-categories include:

- Large-cap funds: Invest in top 100 stable companies

- Mid-cap funds: Focus on medium-sized companies with high growth potential

- Small-cap funds: Target emerging companies; higher returns, higher risk

- Flexi-cap funds: Freedom to invest across large, mid, and small caps

Best for: Long-term goals like retirement, wealth creation

Risk level: Moderate to High

2. Debt Mutual Funds

Think of these like fixed deposits — but a bit more flexible. Debt funds invest in bonds, government securities, and fixed-income instruments.

Common types include:

- Liquid funds: For parking money short-term, safer than savings accounts

- Corporate bond funds: Invest in high-rated corporate debt

- Short-duration funds: Good for 1–3 year goals

Best for: Stability, short-term goals, or conservative investors

Risk level: Low to Moderate

3. Hybrid Mutual Funds

These are the “balanced diet” of investing. Hybrid funds combine both equity and debt, adjusting the mix depending on market conditions.

Popular types include:

- Aggressive hybrid funds: Around 65–80% equity, rest in debt

- Balanced advantage funds (BAFs): Dynamically shift between equity and debt

- Conservative hybrid funds: More focus on debt, with a smaller equity portion

Best for: Beginners who want growth but with some safety net

Risk level: Moderate

Top Performing Mutual Funds in 2025

If you're wondering which mutual funds are giving the best returns this year, we’ve done the homework for you. These funds have stood out in terms of consistent performance, fund management, and investor trust as of June 2025.

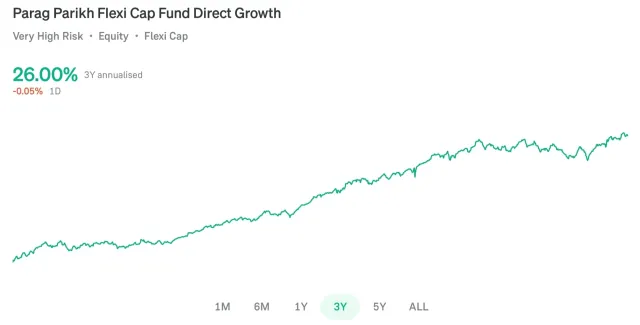

Parag Parikh Flexi Cap Fund

Min. SIP Amount: ₹1,000

Fund Size: ₹1,03,867 Cr (approx.)

Rating: 5-Star

Type: Flexi Cap

Parag Parikh Flexi Cap Fund is known for its well-balanced approach, investing in Indian as well as international stocks. It spreads risk across large, mid, and even global companies like Alphabet and Meta. This strategy offers exposure to diverse markets, helping reduce dependence on any single sector or region.

It is ideal for long-term investors looking for growth with built-in diversification. The fund is managed with a focus on value investing and low portfolio turnover, making it a great choice for investors who want smart decisions without excessive churning.

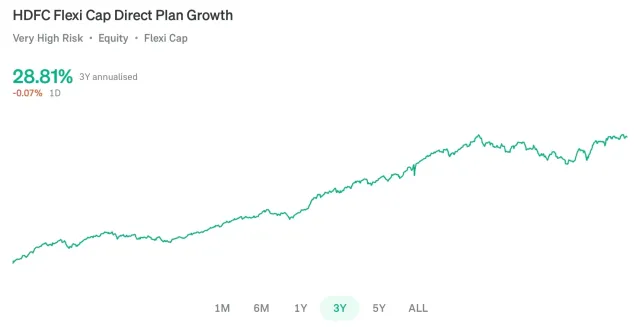

HDFC Flexi Cap Direct Plan Fund

Min. SIP Amount: ₹100

Fund Size: ₹75,784 Cr (approx.)

Rating: 5-Star

Type: Flexi Cap

HDFC Flexi Cap Fund offers a strong domestic equity portfolio and has consistently delivered above-average returns. The fund invests in large, mid, and small-cap stocks based on market opportunities, allowing it to adapt flexibly to changing economic conditions.

It is suitable for investors looking to benefit from the Indian growth story. With strong stock selection and disciplined fund management, this fund aims to deliver sustained performance across market cycles.

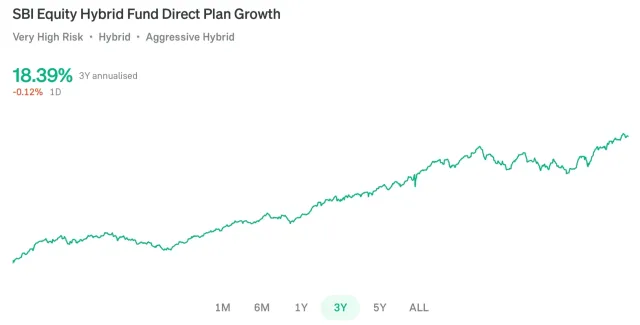

SBI Equity Hybrid Fund

Min. SIP Amount: ₹500

Fund Size: ₹75,639 Cr (approx.)

Rating: 3-Star

Type: Aggressive Hybrid

SBI Equity Hybrid Fund invests around 65–80% in equities and the rest in debt instruments. This mix provides both growth potential and stability, making it ideal for new investors who want to experience the equity market with some downside cushion.

The fund has a long-standing track record of performance and is managed conservatively to ensure smoother returns during volatile periods. It’s a great stepping stone for those transitioning from fixed deposits to equity investments.

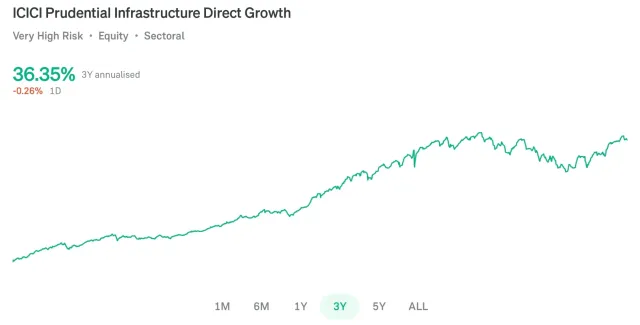

ICICI Prudential Infrastructure Direct Fund

Min. SIP Amount: ₹100

Fund Size: ₹7,920 Cr (approx.)

Rating: 5-Star

Type: Thematic – Infrastructure

ICICI Prudential Infrastructure Fund focuses on one of India's fastest-growing sectors — infrastructure. This includes companies involved in roads, power, construction, transportation, cement, engineering, and capital goods. With India investing heavily in highways, railways, and smart cities, this fund rides the wave of national development.

This fund is ideal for investors who believe in the long-term India growth story and want to capitalise on the country's rapid infrastructure expansion. However, because it's a thematic fund, it can be volatile in the short term. It’s best suited for long-term investors who can tolerate market swings for potentially higher returns.

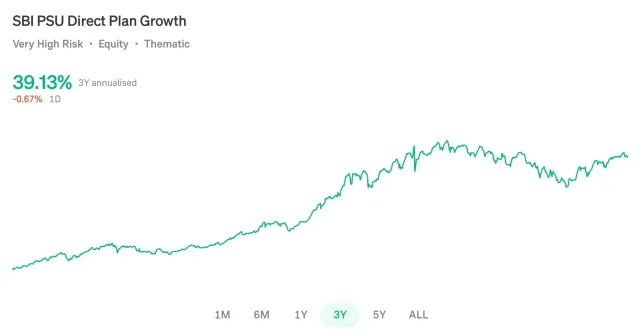

SBI PSU Direct Fund

Min. SIP Amount: ₹500

Fund Size: ₹5,258 Cr (approx.)

Rating: 3-Star

Type: Thematic PSU Equity

SBI PSU Fund invests in public sector enterprises, especially in sectors like energy, utilities, and banking. It has delivered impressive three-year returns of around 29–30 per cent. If you believe in India’s public-sector growth story or want to diversify beyond private-sector heavyweights, this fund offers a focused opportunity.

Of course, PSU performance depends heavily on government policies and sector revival, so it’s best suited for investors willing to bet on that theme.

What is an ETF (Exchange-Traded Fund)?

Imagine a mutual fund and a stock had a baby — that’s an ETF. An Exchange-Traded Fund is a basket of investments (like stocks, bonds, or commodities) that you can buy or sell on the stock exchange just like a regular share.

Let’s say you want to invest in the top 50 companies in India but don’t want to buy each stock one by one. Instead, you can buy one unit of a Nifty 50 ETF, and you instantly own a slice of all 50. Easy, right?

How ETFs Work

- An ETF holds a collection of assets (like stocks in a particular index)

- It tracks the performance of that index (like Nifty 50, Sensex, Nasdaq 100)

- You buy or sell ETF units through your Demat account, just like a stock

- The price of an ETF changes in real-time during market hours

- Most ETFs have very low expense ratios compared to mutual funds

Types of ETFs in India

- Index ETFs: Track indices like Nifty 50, Sensex, or Nasdaq 100

- Gold ETFs: Invest in physical gold, great for portfolio diversification

- International ETFs: Give you exposure to global stocks like Apple, Google, or Tesla

- Sector ETFs: Focus on specific sectors like banking, IT, pharma

- Debt ETFs: Invest in government or corporate bonds for stable returns

Popular ETFs to Know in 2025

| ETF Name | Type | Returns (3-Year CAGR) | Highlight |

|---|---|---|---|

| Nippon India Nifty 50 ETF | Index | ~18.2% | Low cost, broad market exposure |

| ICICI Prudential Nasdaq 100 ETF | International | ~26.7% | Access to US tech stocks |

| HDFC Gold ETF | Commodity | ~12.3% | Hedge against inflation |

| Kotak Banking ETF | Sectoral | ~20.4% | Focused on top Indian banks |

Pros of ETFs

- Traded in real-time like stocks

- Low expense ratios

- Transparent portfolio (you always know what’s inside)

- Great for passive investing

- Easy to diversify even with small amounts

Cons of ETFs

- Requires a Demat and trading account

- No SIP option (unless done via platforms with automation)

- Not actively managed — so no one adjusting the portfolio during market falls

- Liquidity can be low in lesser-known ETFs

Who Should Invest in ETFs?

ETFs are great for investors who like DIY investing, want to track markets directly, or want international exposure with less effort. If you're comfortable buying stocks and tracking the market a bit, ETFs can offer an efficient and affordable way to build wealth.

But if you’re a complete beginner looking for automation, mutual funds (especially through SIPs) might feel easier.

Mutual Funds vs ETFs: What’s the Difference?

At first glance, mutual funds and ETFs look pretty similar — both pool investors' money, both give you access to a basket of assets, and both are managed by professionals. But look closer, and you’ll find some key differences in how they work and who they suit best.

Let’s break it down like comparing two travel styles.

Mutual Funds = Guided Tour

Investing in a mutual fund is like booking a guided holiday package. You tell the company your goal and budget, and they take care of everything — from choosing the route to making bookings. You just sit back and enjoy the ride.

- You don’t need a Demat account

- You can start investing through a SIP

- Prices are updated only once a day (end of day NAV)

- Actively or passively managed by fund managers

- Higher flexibility for complete beginners

Ideal for those who want ease, automation, and hand-holding.

ETFs = Self-Drive Road Trip

An ETF, on the other hand, is like renting a car and planning your own road trip. You have more control — you decide when to start, where to go, and how fast. But you also need to know the road (market) and drive it yourself (via trading platforms).

- You need a Demat and trading account

- You buy and sell ETFs like stocks during market hours

- Lower expense ratios

- Passive style — no frequent intervention from managers

- Great for those who like market control and low costs

Ideal for self-learners or investors who are comfortable using stock market platforms.

Quick Comparison:

| Feature | Mutual Funds | ETFs |

|---|---|---|

| Investment Method | Lump sum or SIP | Buy/sell like stocks |

| Demat Account | Not required | Required |

| Price Updates | Once daily (NAV) | Real-time (market price) |

| Flexibility | Easier for beginners | Better for active or DIY investors |

| Expense Ratio | Slightly higher | Very low |

| Management Style | Active or passive | Mostly passive |

In short: If you prefer convenience and automation, go with mutual funds. If you want control, lower fees, and know your way around a stock platform, ETFs could be your fit.

Join the RedCarpet Circle

Get the latest stories, celebrity updates, and premium features straight to your inbox.

Related Keywords

Advertisement