Top Banks in India 2025: Which Private and PSU Banks Are Leading?

Explore the top banks in India in 2025, including HDFC Bank, SBI, ICICI, and PNB. Know which private and PSU banks are leading in performance, growth, and digital innovation.

Top Banks in India 2025 are not just financial giants — they’re becoming tech-savvy, customer-first, and performance-driven institutions. As India’s economy grows rapidly, the competition between private players like HDFC Bank and ICICI Bank and PSU leaders such as State Bank of India (SBI) and Bank of Baroda has never been sharper. Whether it’s about digital innovation, profit margins, or loan growth, everyone wants to know: Which private and PSU banks are truly leading in 2025?

At RedCarpetLife, we carefully analysed key data like market performance, profit growth, digital innovation, and customer satisfaction to bring you this year’s most trusted list of top private and government banks in India. Our focus was not just on popularity but on consistent performance and meaningful impact.

With India’s economy expanding and banking services reaching deeper into the country, knowing which banks are truly leading in 2025 is crucial. Whether you’re a retail investor, financial planner, or someone considering a banking job, this list gives a clear picture of who is winning in India’s banking space, and why it matters.

Before we reveal the list of top banks in India 2025, it’s important to understand the key factors we used to evaluate and compare both private and government banks.

How We Evaluated the Banks

We considered the following parameters to ensure a fair and insightful review:

- Net Profit Growth – Performance over FY 2024–25

- Return on Assets (ROA) and Equity (ROE) – Indicators of efficiency and profitability

- Gross and Net NPAs – Asset quality and risk management

- Market Capitalization – Size and investor confidence

- Credit Growth – Retail and corporate loan expansion

- Digital Initiatives – Mobile banking, UPI, and tech adoption

- Customer Base and Satisfaction – Reach and trust among users

Top Private Banks in India 2025

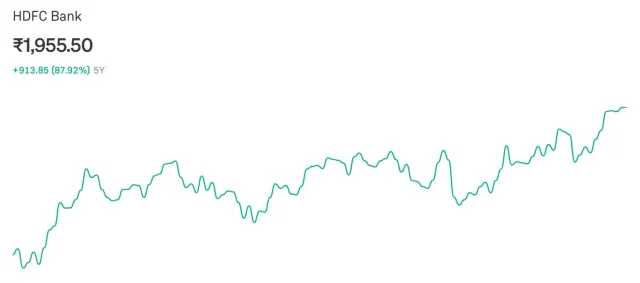

1) HDFC Bank

Market Cap: ₹14.8 lakh crore (approx.)

MD & CEO: Sashidhar Jagdishan

Net Profit FY 2024–25: ₹64,300 crore (approx.)

Headquarters: Mumbai

Founded: 1994

HDFC Bank continues to lead the private banking sector in India, boasting a strong retail customer base and a well-diversified loan portfolio. Its robust presence in digital banking and consistent quarterly growth make it a go-to bank for investors and customers alike.

Despite tight competition, HDFC Bank’s strength lies in its operational efficiency, low non-performing assets (NPAs), and steady profit margins. Its focus on innovation, from AI-based credit scoring to advanced net banking services, has helped it stay ahead in the digital race.

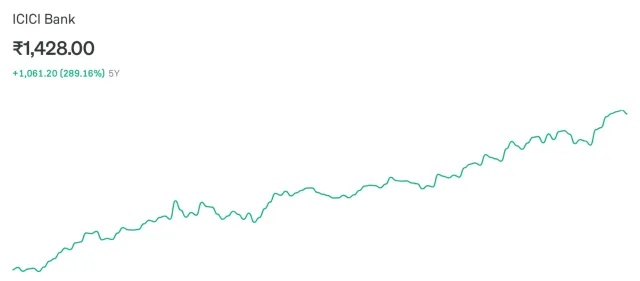

2) ICICI Bank

Market Cap: ₹10.06 lakh crore (approx.)

MD & CEO: Sandeep Bakhshi

Net Profit FY 2024–25: ₹45,300 crore (approx.)

Headquarters: Mumbai

Founded: 1994

ICICI Bank has emerged as a powerful force in India’s private banking sector with its aggressive growth in retail lending, especially home loans and personal loans. The bank also continues to grow its wealth management and corporate lending portfolio.

Its rise in profitability and tight control over bad loans have impressed investors. What sets ICICI apart is its dynamic strategy, quick to adapt and highly focused on using tech for customer service, digital payments, and credit distribution.

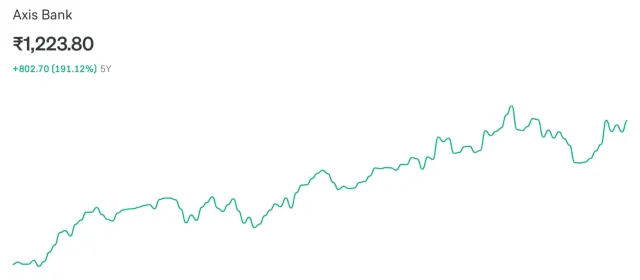

3) Axis Bank

Market Cap: ₹3.7 lakh crore (approx.)

MD & CEO: Amitabh Chaudhry

Net Profit FY 2024–25: ₹26,424 crore (approx.)

Headquarters: Mumbai

Founded: 1993

Axis Bank has strengthened its position in 2025 with a sharp focus on retail banking, credit cards, and small business loans. Its acquisition of Citi's retail business further deepened its customer base and portfolio diversity, especially in urban India.

What makes Axis stand out is its proactive digital strategy. With upgraded mobile banking, AI-based fraud detection, and smart wealth tools, the bank is positioning itself as a tech-first player without losing sight of traditional service quality.

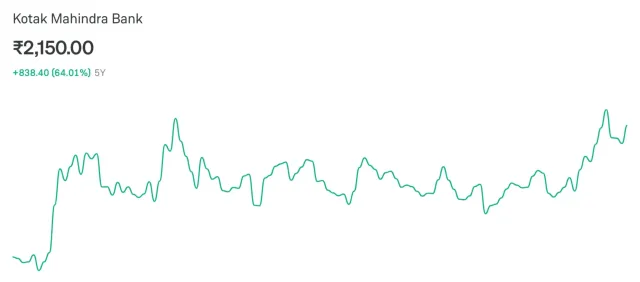

4) Kotak Mahindra Bank

Market Cap: ₹4.26 lakh crore (approx.)

MD & CEO: Ashok Vaswani

Net Profit FY 2024–25: ₹17,977 crore (approx.)

Headquarters: Mumbai

Founded: 2003 (converted from NBFC to bank)

Kotak Mahindra Bank maintains its niche position among private banks, known for conservative risk practices and premium banking services. While its pace of expansion is measured, its financial stability and efficient cost management remain strong points.

Kotak's strength lies in selective lending, strong CASA ratio, and premium customer relationships. With gradual tech upgrades and growing interest in digital wealth management, Kotak continues to appeal to high-value and digitally aware clients.

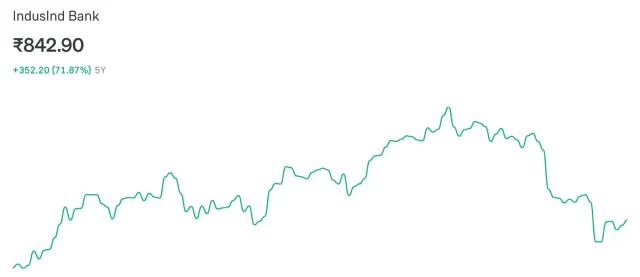

5) IndusInd Bank

Market Cap: ₹65,246 crore (approx.)

MD & CEO: Sumant Kathpalia

Net Profit FY25: ₹8,900 crore (approx.)

Headquarters: Mumbai

Founded: 1994

IndusInd Bank continues to grow steadily in 2025 with a strong focus on vehicle finance, microfinance, and mid-sized corporate lending. The bank has carved out a unique niche in sectors often overlooked by larger private players, helping it grow in semi-urban and rural areas.

While it faced challenges in the past with asset quality, its recent improvements in risk control, digital onboarding, and loan diversification have boosted both investor confidence and customer base. IndusInd's customer-first approach and branch-level tech innovation are helping it compete effectively in a crowded market.

Top Government (PSU) Banks in India 2025

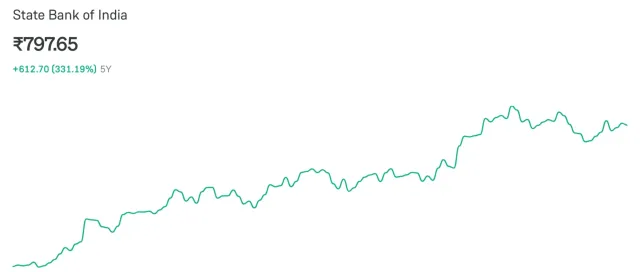

1) State Bank of India (SBI)

Market Cap: ₹7.3 lakh crore (approx.)

Chairman: Dinesh Kumar Khara

Net Profit FY25: ₹79,000 crore (approx.)

Headquarters: Mumbai

Founded: 1955

State Bank of India continues to dominate India’s public banking sector, both in size and profitability. With its vast rural and urban network, SBI plays a vital role in financial inclusion, while also leading in tech adoption among PSU banks through YONO and UPI integrations.

In 2025, SBI remains the most trusted public sector brand with a balanced lending portfolio across retail, SME, and corporate segments. It has significantly improved asset quality over the years, making it a consistent performer even in challenging economic cycles.

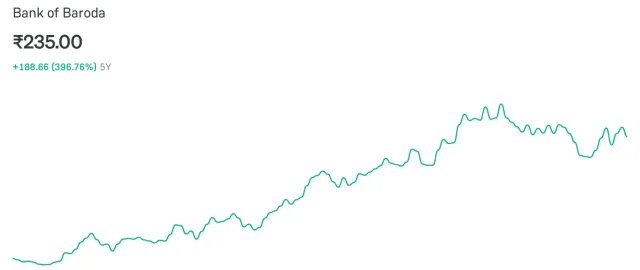

2) Bank of Baroda (BoB)

Market Cap: ₹1.3 lakh crore (approx.)

MD & CEO: Debadatta Chand

Net Profit FY25: ₹20,459 crore (approx.)

Headquarters: Vadodara

Founded: 1908

Bank of Baroda has firmly positioned itself as a modern PSU bank with a strong digital push and improving profitability. Its merger with Dena Bank and Vijaya Bank has matured into a well-integrated network, allowing it to scale operations across regions efficiently.

In 2025, BoB has shown consistent loan book growth, better NPA management, and rising retail deposits. With renewed focus on MSME lending and personal banking, along with a user-friendly app interface, the bank continues to attract both traditional and tech-savvy customers.

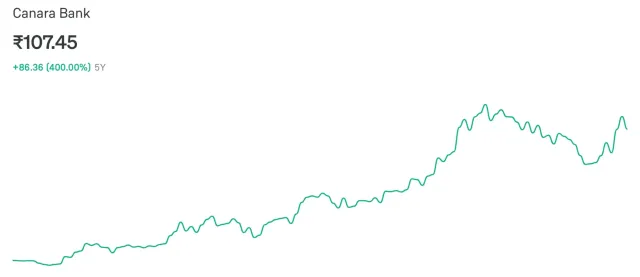

3) Canara Bank

Market Cap: ₹95,106 crore (approx.)

MD & CEO: K. Satyanarayana Raju

Net Profit FY25: ₹17,336 crore (approx.)

Headquarters: Bengaluru

Founded: 1906

Canara Bank has emerged as one of the strongest performers among PSU banks in recent years. After its merger with Syndicate Bank, the institution streamlined operations, expanded its reach, and reinforced its lending strength, especially in the retail and MSME segments.

In 2025, the bank’s digital initiatives, like AI-driven chatbots and self-service kiosks, are attracting a younger audience. With improving asset quality, competitive loan offerings, and rising CASA ratios, Canara Bank is proving that public sector banks can be just as dynamic as their private counterparts.

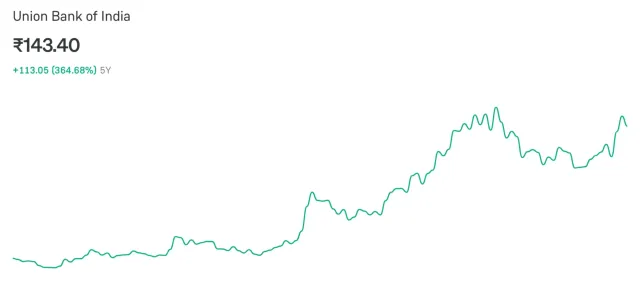

4) Union Bank of India

Market Cap: ₹1.06 lakh crore (approx.)

MD & CEO: A. Manimekhalai

Net Profit FY 2024–25: ₹13,600 crore (approx.)

Headquarters: Mumbai

Founded: 1919

Union Bank of India has made remarkable progress since its merger with Andhra Bank and Corporation Bank. The combined strength has given it scale, while a strong push toward digitisation and branch modernisation has improved its customer experience significantly.

In 2025, Union Bank stands out for its improving loan book, growing digital transactions, and better NPA control. Its focus on financial inclusion, agricultural lending, and rural expansion continues to align well with government priorities, helping it build trust and stability.

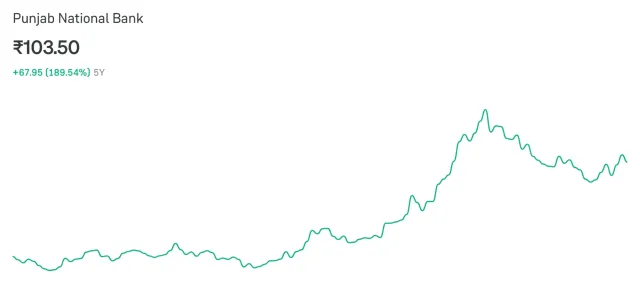

5) Punjab National Bank (PNB)

Market Cap: ₹1.18 lakh crore (approx.)

MD & CEO: Atul Kumar Goel

Net Profit FY 2024–25: ₹18,553 crore (approx.)

Headquarters: New Delhi

Founded: 1894

Punjab National Bank remains one of India’s largest government banks by reach and customer base. Post-merger with Oriental Bank of Commerce and United Bank, PNB has been working on improving operational efficiency and technology-driven banking.

In 2025, PNB is showing steady growth in both retail and corporate lending. Its renewed focus on digital banking, reduction in NPAs, and better risk management practices are helping rebuild its reputation and attract long-term investors.

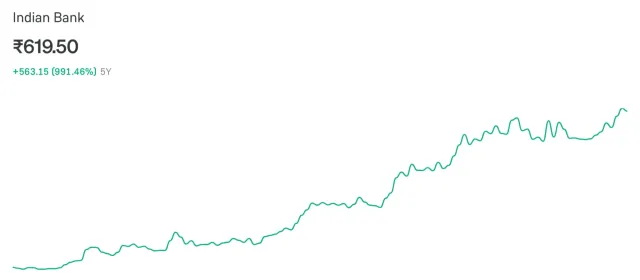

6) Indian Bank

Market Cap: ₹82,838 crore (approx.)

MD & CEO: Shanti Lal Jain

Net Profit FY 2024–25: ₹10,995 crore (approx.)

Headquarters: Chennai

Founded: 1907

Indian Bank has steadily risen as a trusted PSU bank following its merger with Allahabad Bank. It has shown strength in areas like agricultural loans, MSME support, and rural banking infrastructure, all while keeping a close eye on asset quality.

In 2025, the bank has enhanced its digital presence with intuitive mobile platforms and upgraded core banking services. Its strategy of focusing on underserved markets, combined with sound financial management, makes it a strong public-sector performer in a competitive space.

ALSO READ| Why These 5 Indian Startups Failed & What You Can Learn

Private vs PSU Banks in India 2025

| Bank Name | Type | Net Profit (FY 2024–25) | Market Cap (₹ Cr) | Tech & Digital Presence | NPA Control |

|---|---|---|---|---|---|

| HDFC Bank | Private | ₹64,300 Cr | ₹14.8 Lakh Cr | Advanced (AI, UPI, Mobile) | Strong |

| ICICI Bank | Private | ₹45,300 Cr | ₹10.06 Lakh Cr | Advanced & Scalable | Excellent |

| Axis Bank | Private | ₹26,424 Cr | ₹3.7 Lakh Cr | Strong | Improved |

| Kotak Mahindra Bank | Private | ₹17,977 Cr | ₹4.26 Lakh Cr | Moderate | Very Strong |

| IndusInd Bank | Private | ₹8,900 Cr | ₹65,246 Cr | Growing | Improving |

| SBI | PSU | ₹79,000 Cr | ₹7.3 Lakh Cr | Very Strong | Good |

| Bank of Baroda | PSU | ₹20,459 Cr | ₹1.3 Lakh Cr | Growing Fast | Improving |

| Canara Bank | PSU | ₹17,336 Cr | ₹95,106 Cr | Expanding | Better Than Past |

| Union Bank of India | PSU | ₹13,600 Cr | ₹1.06 Lakh Cr | Upgraded | Improved |

| Indian Bank | PSU | ₹10,995 Cr | ₹82,838 Cr | Moderate | Controlled |

| Punjab National Bank | PSU | ₹18,553 Cr | ₹1.18 Lakh Cr | Revamping | Improving |

ALSO READ| What Are SIPs, Mutual Funds, and ETFs? Learn the Basics of Investing

Frequently Asked Questions (FAQs) – Top Indian Banks 2025

🔹 Which is the No. 1 private bank in India in 2025?

HDFC Bank continues to be the top private bank in India in 2025, with the highest market cap and consistent profits, thanks to strong retail banking and tech leadership.

🔹 Which government bank is performing best in 2025?

State Bank of India (SBI) leads among PSU banks in both profitability and digital innovation, followed by Bank of Baroda and Canara Bank.

🔹 Are PSU banks improving their performance?

Yes, PSU banks have significantly improved in 2025. With stronger asset quality, tech upgrades, and better customer service, many are now competing closely with private banks.

🔹 Which bank is better for digital banking services in 2025?

Private banks like ICICI, HDFC, and Kotak Mahindra Bank offer top-tier digital platforms. Among PSU banks, SBI stands out with apps like YONO and seamless UPI services.

🔹 Should I invest in private or PSU bank stocks?

Private banks offer stable returns and innovation, while PSU banks provide value opportunities as they continue restructuring. The best choice depends on your investment goals and risk appetite.

Join the RedCarpet Circle

Get the latest stories, celebrity updates, and premium features straight to your inbox.

Related Keywords

Advertisement