India's EV Market in 2025: Growth, Top Companies, and Challenges

India’s EV Market in 2025 is booming. From Tata Motors to Ola Electric and Ather, discover top EV companies, real growth trends, and the biggest roadblocks shaping India’s electric future.

India's EV market in 2025 has shifted from potential to performance. What once felt like a green dream is now a buzzing reality, with electric vehicles silently taking over highways and street corners alike. The momentum is real, the numbers are rising, and the future is electric.

At RedCarpetLife, we explored India’s electric vehicle growth story to uncover what’s truly powering the shift. From top companies like Tata Motors and Ola Electric to everyday buyers in small towns, the EV wave is no longer limited to early adopters — it’s moving mainstream.

This year is crucial. With over 2 million EVs expected to hit the roads, the country is experiencing rapid adoption driven by smart policies, charging infrastructure, and bold company strategies. But behind the surge lie big challenges — from battery sourcing to affordability. In this article, we break down India’s EV growth, top players leading the charge, and the roadblocks that must be tackled next.

India's EV Market in 2025

Where India’s EV Market Stands in 2025?

In 2025, India's EV market has become one of the fastest-growing in the world. With over 2 million EVs expected on roads this year, the growth isn’t just visible — it's unstoppable.

Electric two-wheelers dominate the space, accounting for more than 60 per cent of sales, while electric cars, buses, and even trucks are entering more cities and highways across the country.

EV Growth Snapshot (2025)

- Total EV sales: Expected to cross 2 million

- Top segment: Two-wheelers (Ola, Ather, TVS)

- Top state adopters: Maharashtra, Tamil Nadu, Delhi

- Penetration goal: 30% EV share by 2030 (NITI Aayog)

EV Growth in India: 2020 to 2025

| Year | EV Units Sold | YoY Growth (%) | Market Highlights |

|---|---|---|---|

| 2020 | 1.2 lakh | — | Early adopters, mostly e-rickshaws and fleets |

| 2021 | 3.1 lakh | +158% | Ola enters EV space, state subsidies increase |

| 2022 | 10 lakh | +222% | Tata Nexon EV gains popularity, infra ramps up |

| 2023 | 13.5 lakh | +35% | Battery cost dips, startups surge |

| 2024 | 17.9 lakh | +32% | More launches, tier 2 city adoption rises |

| 2025* | 21–22 lakh | Est. +25% | EVs become mainstream, infra hits 15k+ stations |

Note: 2025 data is projected using FADA and Vahan dashboard trends up to May 2025.

Government Push

The FAME II scheme continues to drive EV affordability with central subsidies, while many states offer free registration, road tax waivers, and startup grants. Cities like Delhi and Chennai have emerged as EV policy leaders.

🟢 RedCarpetLife Insight: Most startups entering the EV ecosystem in 2025 are not just building vehicles, but also working on batteries, software, and charging networks — showing how broad the industry has become.

Charging Infrastructure in 2025

🧠 Did You Know? In 2020, charging stations were mostly limited to a few metros. Now in 2025, they’re present even along NH44 and state highways in Rajasthan and Tamil Nadu.

Top EV Companies in India 2025

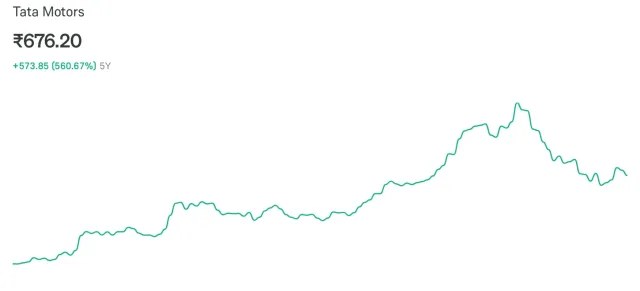

Tata Motors

Market Cap: ₹2.5 lakh crore (approx)

MD & CEO: Shailesh Chandra (EV Division)

Key Models: Nexon EV, Tiago EV, Punch EV

Focus Area: Passenger electric four-wheelers

Tata Motors has become the uncontested king of India’s four-wheeler EV segment. The Nexon EV, which began as a niche product, is now a household name across metros and tier-2 cities alike. With reliable range, great design, and smart pricing, Tata cracked the Indian EV formula early — and is now building on it with multiple variants.

What makes Tata stand out is its full-stack approach. From in-house batteries to dedicated EV showrooms and partnerships with Tata Power for charging infrastructure, it’s creating an entire EV ecosystem. The result? Over 65% market share in the electric four-wheeler segment as of mid-2025.

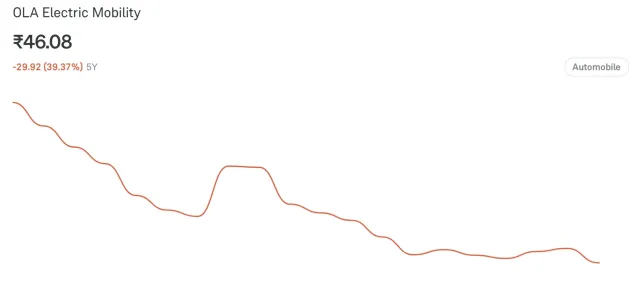

Ola Electric

Market Cap: ₹20,312 crore

Founder & CEO: Bhavish Aggarwal

Key Models: Ola S1 Air, Ola S1 Pro, Ola S1 X

Focus Area: Electric two-wheelers and scooters

From bold marketing to the world’s largest scooter factory, Ola Electric has disrupted the EV space. In 2025, it continues to dominate electric scooter sales with sleek, software-driven vehicles at multiple price points. The Ola S1 Air is especially popular among daily commuters for its affordability and features.

But Ola is not just about scooters anymore — it has started prototyping its first electric motorcycle and is also investing in lithium cell manufacturing. While critics have questioned quality and service issues in earlier phases, Ola’s aggressive expansion is pushing India’s EV boundaries every quarter.

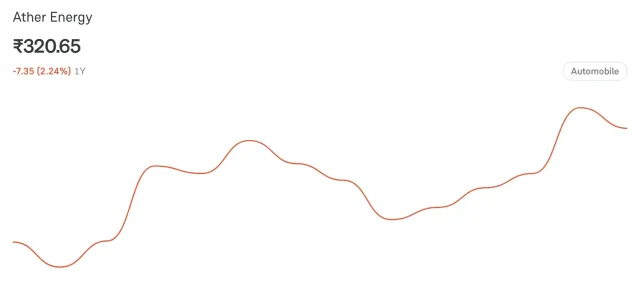

Ather Energy

Market Cap: Approx ₹11,947 crore

CEO: Tarun Mehta

Key Models: Ather 450S, 450X Gen 3, 450 Apex

Focus Area: Premium electric scooters with smart features

Ather Energy is carving a solid space in India’s premium e-scooter segment. While Ola rules on volume, Ather rules on loyalty and refinement. With a strong user community and software-driven dashboards, Ather scooters are seen as the iPhones of the EV scooter market.

In 2025, the newly launched 450 Apex with better acceleration and performance updates is a big hit in urban hubs. Ather also expanded its network to over 200 experience centres across India and launched grid 2.0 charging tech, making it one of the most customer-loved EV brands. While volumes may trail Ola, brand trust and satisfaction remain Ather’s strongest assets.

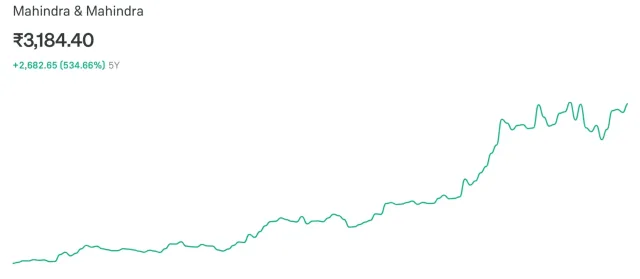

Mahindra Electric

Market Cap (Group): ₹3.95 lakh crore (Auto Division M&M)

CEO (Auto & Farm): Suman Mishra

Key Models: XUV400 EV, Treo Zor, Jeeto EV (2025)

Focus Area: Passenger EVs, e-3W, and commercial light vehicles

Mahindra has taken a two-pronged approach to EVs — mass-market commercial EVs and SUV-style electric cars. While the XUV400 remains a popular midsize e-SUV, Mahindra’s strength lies in its fleet-focused electric three-wheelers like Treo Zor, especially in logistics and e-commerce sectors.

In 2025, Mahindra launched the Jeeto EV, a compact goods carrier for last-mile delivery. With FAME II incentives and growing demand for clean cargo mobility, it’s become a hit among delivery fleets in Mumbai, Hyderabad, and Bengaluru. Mahindra’s Born Electric platform, set to roll out fully by 2026, could be a game changer.

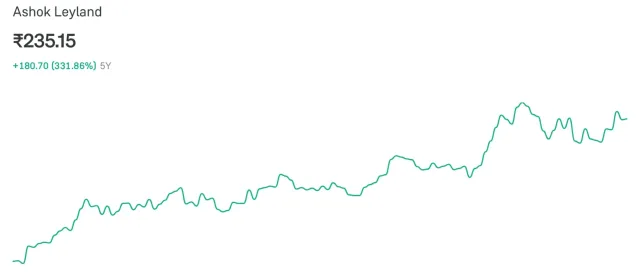

Switch Mobility (Ashok Leyland)

Market Cap (Parent): ₹69,000 crore (Ashok Leyland, auto & E‑mobility division)

CEO (EV Business): Amit Shelkikar

Key Models: Switch EiV 22, EiV 12, Electric buses and LCV variants

Focus Area: Electric commercial vehicles – buses, logistics trucks, and small goods carriers

Switch Mobility has emerged as Ashok Leyland’s EV-focused arm, and in 2025, it’s making major strides. With the EiV 22 electric bus running in cities like Delhi and Hyderabad and LCV variants rolling out across logistics fleets in Mumbai, it’s redefining commercial EV use cases in India.

What sets Switch Mobility apart is its integration with existing transport ecosystems. Their electric buses are backed by maintenance contracts, charging setups, and fleet management tools. For cities aiming to electrify public transport, Switch offers a turnkey solution, not just a vehicle.

ALSO READ| Electric Luxury Cars: Top Models That Go Green in Style

Comparison of Top EV Companies in India 2025

| Brand | Segment Focus | Top Models | Market Position (2025) | Key Strengths | Ownership Type |

|---|---|---|---|---|---|

| Tata Motors | 4-wheeler EVs (mass) | Nexon EV, Tiago EV | ~65% share in EV car market | Ecosystem integration, strong brand trust | Publicly listed |

| Ola Electric | 2-wheeler EVs (volume) | Ola S1 Pro, S1 Air | Leader in scooter volumes | Price, design, scale, in-house factory | Publicly listed |

| Ather Energy | 2-wheeler EVs (premium) | Ather 450X, 450 Apex | Popular in urban premium segment | Smart UI, quality, loyal community | Publicly listed |

| Mahindra | 3-wheeler & SUV EVs | XUV400 EV, Treo Zor | Leader in fleet and utility EVs | Commercial segment strength | Publicly listed |

| Ashok Leyland / Switch | Electric buses & LCVs | EiV 22, EiV 12 | Dominant in electric public transport | Govt contracts, proven infra partnerships | Publicly listed |

| BYD India | Passenger & fleet EVs | e6 MPV, Atto 3 SUV | Premium segment with fleet adoption | Global tech, strong battery division | Private (Global) |

🧠 Tip for Readers: Each company plays a different role in India's EV landscape. If you're a buyer, investor, or policymaker, this table helps you understand who is doing what, and why that matters in 2025.

❓ Frequently Asked Questions (FAQs)

🔹 What is the current size of India's EV market in 2025?

India’s EV market has crossed 2 million vehicle sales in 2025, with electric two-wheelers accounting for the largest share. The market is growing at over 25 per cent annually, driven by policy support and increasing affordability.

🔹 Which companies are leading India's EV sector in 2025?

Top EV players in 2025 include Tata Motors, Ola Electric, Ather Energy, Mahindra Electric, Switch Mobility (Ashok Leyland), and BYD India. Each company leads in a specific segment, from e-scooters to commercial electric vehicles.

🔹 Is India ready for mass EV adoption?

Yes. With 15,000+ public charging stations, state-level subsidies, and growing consumer trust, India is rapidly embracing EVs — not just in metro cities, but also in tier-2 and tier-3 towns.

🔹 Are electric vehicles affordable in India now?

Definitely. Thanks to FAME II, GST cuts, and local battery manufacturing, EVs have become more affordable. Many e-scooters are priced under ₹90,000, and electric cars like the Tiago EV start from around ₹8 lakh.

🔹 What challenges does the Indian EV industry face?

Key challenges include limited rural infrastructure, high battery import dependency, and after-sales servicing gaps. However, 2025 is seeing large investments in Indian battery gigafactories and faster policy execution to tackle these.

🔹 Which states are leading EV adoption in India?

Delhi, Maharashtra, Tamil Nadu, and Karnataka are leading the EV transition with aggressive subsidy programs, manufacturing parks, and fast-growing charging networks.

Join the RedCarpet Circle

Get the latest stories, celebrity updates, and premium features straight to your inbox.

Related Keywords

Advertisement